HR Compliance Bulletin: IRS Issues Guidance on Tax Credits for Coronavirus Paid Leave

Small and midsize employers may begin using two new refundable payroll tax credits to obtain reimbursement for the costs of providing coronavirus-related leave to their employees, the U.S. Department of Labor (DOL) and Internal Revenue Service (IRS) announced on March 20, 2020.

This relief is provided under the Families First Coronavirus Response Act (the Act), which was enacted on March 18, 2020. The Act provides funds for employers with fewer than 500 employees to provide paid leave, either for their employees’ own health needs or to care for their family members. The Act aims to help employers keep workers on their payrolls while ensuring that workers are not forced to choose between their paychecks and the public health measures needed to combat the coronavirus (COVID-19).

This Compliance Bulletin provides the DOL and IRS’ guidance.

HR Compliance Bulletin: Guidance on Tax Credits for Coronavirus Paid Leave

If you have any questions or would like additional information please contact our office at 617-723-0700.

Risk Management During the COVID-19 Pandemic

Most of us are now working from home, but everyone at Cleary Insurance is still available to assist you with your insurance and risk management needs, as are all the insurance carriers we represent. We will still meet with you if required, but we strongly encourage all communication to be via email or telephone.

In this past week, we have fielded many inquiries from our clients, and the areas of greatest concern appear to be the following:

- Health Insurance: routine doctor and dentist office visits have all been cancelled or postponed, as has any elective or non-emergency surgery. This is being done both to stem the spread of the coronavirus, and to prepare for the anticipated need for hospitals to adequately respond to patients with COVID 19. Health insurance carriers have also eliminated co-pays, deductibles, and co-insurance for all coronavirus related testing, procedures, and treatments.

- Loss of Income/Business Interruption Insurance: Many clients have asked if this coverage applies to the current pandemic, and the unfortunate answer is no. Lawsuits are being filed in New Orleans, legislation has been introduced in New Jersey, and industry associations are lobbying Congress to pass Terrorism-like insurance relief funds, but as of now, there is no such coverage available.

- Cyber Liability: In the past three months, over 4,000 domain names have been registered with the terms “Corona” or “Covid”. Hackers will be looking to exploit employees working from home with phishing emails, knowing that new procedures at work, combined with improper (or non-existent) firewalls, will provide easy prey for these scams. Please be vigilant and on the lookout for such fraudulent emails.

- Workers Compensation: Workers Compensation cases relating to COVID 19 illness will be determined on a case to case basis. A worker becoming sick from the flu is not typically covered under Workers Compensation. In order to be covered, it must be demonstrated that the illness was contracted as a direct result of employment, with a greater risk than that from the general public. A health worker treating flu patients could fall into this category, but such would not apply to most occupations.

As always, we welcome your questions, emails, and calls. We will also be updating our postings to make sure that we provide the best risk management advice to our clients during these turbulent and unnerving times.

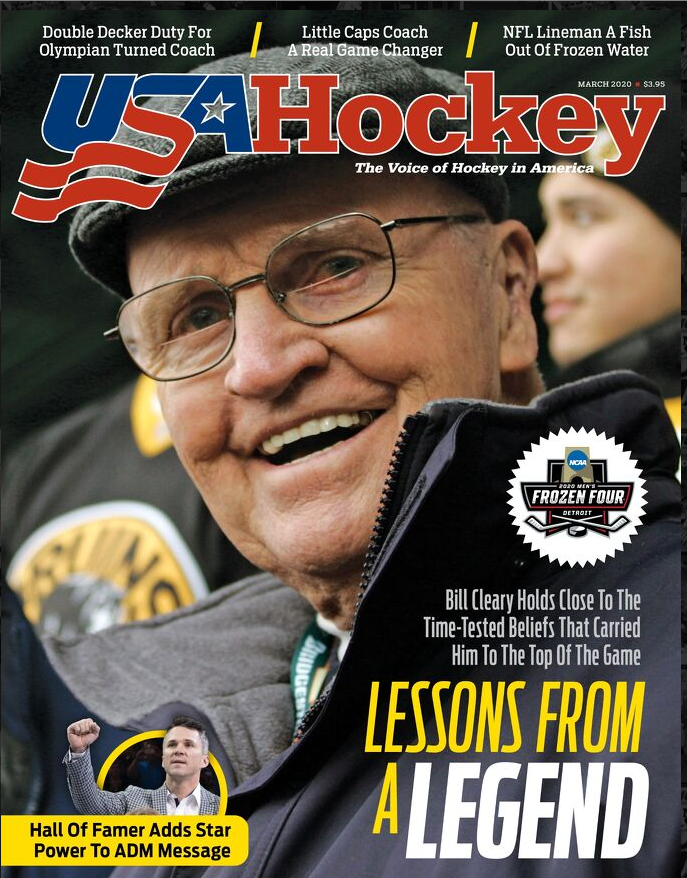

Lessons From a Legend – Bill Cleary, Jr.

Please click here to read an inspiring article about Bill Cleary, Jr.