4 Questions to Ask Yourself When Considering Renter’s Insurance

When most people think about insurance, they associate it with buying a car or home. Renter’s insurance is often overshadowed in this way. Even though renter’s insurance is not always required, it’s still important when considering the net worth of your personal items.

At Cleary, we recommend renter’s insurance so that you’re protected against the damage or loss of personal property when you rent an apartment or house and have liability protection in case any lawsuits are made against you.

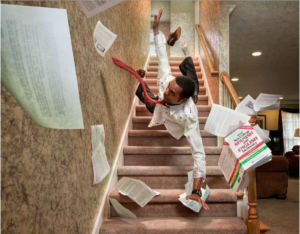

For example, if someone gets hurt on your rented property, and he or she decides to sue you, renter’s insurance will likely pay for both the injured person’s medical expenses as well as a lawyer.

Sounds pretty good, right?

Here are a few questions to ask yourself when you consider renter’s insurance:

- How much would it cost to replace my belongings if they were damaged or stolen?

- Could I afford to replace them?

- Do I live in an area prone to theft or other destructive forces?

- Can I afford Replacement Cost* coverage over Actual Cash Value (ACV)**?

* Replacement Cost refers to the cost of replacing lost or damaged items

** ACV involves the monetary reimbursement for what the item would have been worth by an insurance company.

If you’re still having trouble deciding, contact us and we’ll give you the skinny on renter’s insurance.