3 Important Tips for Filing your Commercial Insurance Claim

Whether the damage is small or large, tangible or not, any business owner in the process of filing a commercial insurance claim faces a good deal of stress. More time and effort is needed to maintain the business while repairs are negotiated with the insurance policy provider.

We encourage small businesses to take a look at policies every 2-3 years to ensure they’re properly covered. Prevention is also key: owners should evaluate possible threats to the business, develop recovery plans, and test those plans all in advance.

Scott Lacourse, a contributing writer for the Boston Business Journal, makes a crucial note in relation to small businesses:

“Many small businesses skip insurance altogether, or fail to get the coverage they need to cope with incidents like major flooding. Almost 40 percent of small businesses never reopen following a disaster, according to FEMA.”

The strength of this data demonstrates the importance of analyzing acquired insurance policies and minimizing the effects of destructive events. However, should an occurrence arise, we’ve put together three tips to help with your next (or current) commercial insurance claim:

Be attentive to coverage policy time periods

If a claim must be made, owners should take considerable care in filing the claim within the temporal parameters set by the insurance provider. Otherwise, extra costs and impediments may extend the amount of time for recuperation.

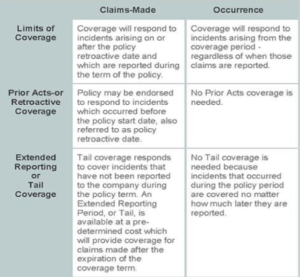

Below is a chart that outlines the time-based functions of certain insurance policies as they handle declared claims and actual occurrences.

If you have questions specific to your policy, contact your agent. However, rest assured that, as shown above, real occurrences (during the policy period) will most always be covered, “no matter how much later they are reported.”

Take inventory, record documents, and stay organized

The evidence for a claim to be submitted needs to be kept together and controlled. Keeping track of all damage is crucial if these problems are to be resolved efficiently.

Some ways to organize include taking inventory of all materials affected, protecting all documents and copies that may be related to the incident, and even taking pictures or procuring a claim from the police (if the situation is applicable).

It also wouldn’t hurt to stay in touch and follow up with the people involved, especially your insurance adjuster.

Hire a loss management team

In the case of large claims, owners might consider hiring a loss management team.

A loss management team could consist of a professional loss specialist, legal expert, or forensic accountant who would help file the claim. Commercial insurance claims are of a legal nature, after all, and if business owners are not experts in this field, it could help to have someone who is on their side.

This decision, again, would depend upon the severity of the incident that caused the claim and if the owner would find such a support group financially feasible—as it would involve added costs.